Step 1: Identify Your Goals

How Do I Start Investing?

How Do I Start Investing?

Written by AFFIN HWANG TEAM

Published 17/01/2025

“I bought this stock to earn dividends, but now the share price is dropping. Should I sell or hold on?”

Does this sound familiar? Investors without a clear goal and strategy often struggle to make the right investing decisions, especially during market downturns. This is why setting clear investment goals and strategies are essential because they help guide your decisions, even during unpredictable times.

Follow these 5 steps to set your investment roadmap

Step 1: Identify Your Goals

Step 2: Calculate The Returns Needed To Achieve Your Milestones

Step 3: Decide On Your Portfolio Strategy Based On Your Risk Appetite

Step 4: Choose The Right Investment Instruments

Step 5: Track The Performance

Step 1: Identify Your Goals

The first step in starting your investment journey is identifying what you want to achieve. This provides a roadmap for your decisions.

Let’s say that you’re an investor aged 30 and would like to buy a house worth RM400,000. To define your goals, try to answer these key questions:

| No. | Question | Sample answer |

|---|---|---|

| 1 | What am I investing for? | I want to pay for my dream house’s downpayment cost of about RM40,000 by aged 35. |

| 2 | What is my investment timeline? | I have 5 years to achieve my goal. |

| 3 | How much risk am I willing to take? | I am comfortable with losing 10% of my capital to potentially earn 15% of returns. |

| 4 | How much can I invest regularly? | I have initial capital of RM5,000 and can top up my investment by RM500 every month. |

| 5 | Do I have an emergency fund? | I have enough savings that can maintain my current lifestyle for at least 3 months. |

| 6 | What’s my exit strategy? | I want an asset that can be sold and cashed out within 2 days in the event of emergency. |

Through this assessment, you’ll have a clear understanding of your financial priorities and would be equipped to stay on track, even when the stock market becomes unpredictable.

Step 2: Calculate the Returns Needed to Achieve Your Milestones

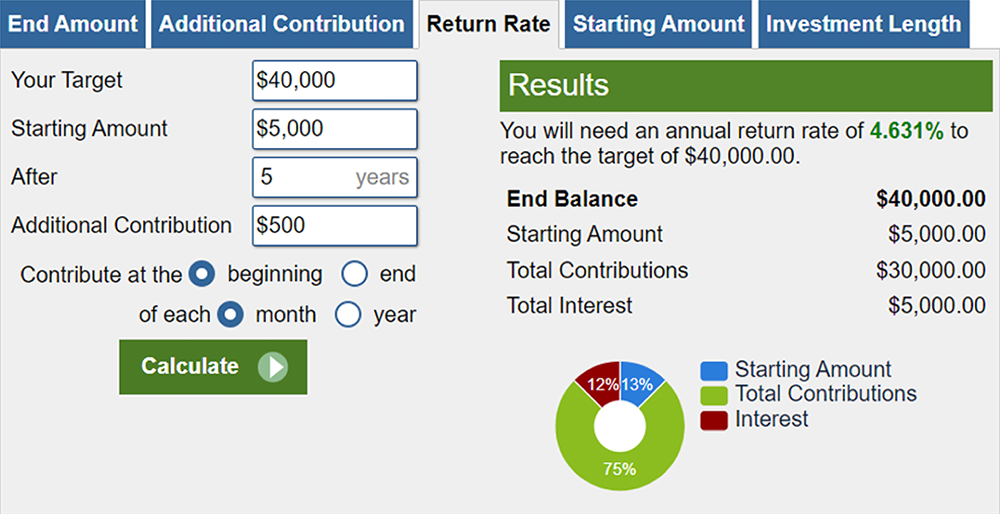

Now that you have identified your goals, let us determine the investment returns required to reach them. Use this investment calculator by calculator.net to help you calculate the returns that you should aim for.

Here’s an example simulation:

To grow the initial RM5,000 capital to RM40,000 within 5 years with a monthly top up of RM500, you need an annual return of about 4.63%* per year– which is a realistic and achievable goal given that there are dividend stocks that give dividend of averagely 5% return per year.

*Provided that all returns are being reinvested with compounding effect.

Step 3: Decide On Your Portfolio Strategy Based On Your Risk Appetite

Think of a portfolio as a basket that holds different types of investments such as stocks, bonds, and cash. A portfolio strategy is how you decide to split your money across these types of investments. Imagine you are planning a meal and want a healthy balance of foods. In your portfolio, you want a balance of investments to meet your goals and suit your comfort level with risks.

Example, if you are cautious and do not want significant highs and lows, you may consider investing more in bonds (safer) and less in stocks (riskier). If you are comfortable with taking some risks for more growth, you may want to consider investing in stocks and less in bonds.

Stocks vs Bonds

When you buy stocks, you are buying a small piece of a company. It is like owning a tiny share of that business. If the company does well, the value of your stock goes up, and you might earn money by selling it for more than you have paid. Sometimes, companies also pay dividends, which are small cash payments to shareholders out of the company’s profits.

A bond is like a loan you give to a company or government. When you buy a bond, you are lending them money, and in return, they promise to pay you back with a bit of extra money (interest) over time. Bonds are usually less risky than stocks because you are lending money, not owning part of the company.

Here are the 3 common portfolio strategies

|

Conservative Portfolio |

Balanced Portfolio |

Aggressive Portfolio |

|

|---|---|---|---|

|

Asset Allocation |

Bonds : Stocks

70 : 30 |

Bonds : Stocks

40 : 60 |

Bonds : Stocks

30 : 70 |

| Expected Return |

Generally Low |

Moderate |

Higher |

| Risk Level |

Low |

Medium |

High |

| Best For |

Investors who are looking to protect their initial investment and hedge inflation rather than seeking high growth. |

Investors with a moderate risk tolerance and a time horizon of 5-10 years.

|

Younger investors with a long-time horizon (10+ years) and higher risk tolerance. |

| Suitable Use Case |

Near-term goals e.g. paying for house down paymeant. |

Children’s education or early retirement. |

Long-term goal, such as retirement. |

In this case, since you are going to pay for your house downpayment in the next 5 years, you may consider the lower-risk conversative portfolio to invest more in fixed-income assets or money market funds, which provide regular, stable returns; as well as dividend-paying or blue-chip stocks, which offer some growth but with less volatility.

Dividend stocks are shares of companies that regularly pay out a portion of their profits to shareholders in the form of dividends.

Blue-chip stocks are shares of large, well-known companies with a solid reputation and a history of financial stability, such as Petronas Gas Berhad. These companies are often leaders in their industries and tend to perform well over time. Many blue-chip stocks also pay dividends.

Step 4: Choose the Right Investment Instruments

For beginners, it’s advisable to start investing locally, in your home country, Malaysia. This is because new investors are usually familiar with local businesses and markets, and they receive news and updates faster. In Malaysia, you can access various asset classes through Bursa Malaysia Berhad (the Malaysian stock exchange). Each option has a different level of risk, return, and complexity.

The most common asset classes for beginners are unit trusts, Exchange-Traded Funds (ETFs), and individual stocks. Each of these options offers liquidity (the ability to cash out easily), simplicity, and relatively lower risks:

How Retail Investors Can Invest in Bonds

While bonds are often bought directly by large institutions or sophisticated investors, retail investors (individuals like you and me) typically do not buy individual bonds directly. Instead, they can consider Bond Funds (similar to unit trusts) or Exchange-Traded Bonds (ETBs) (similar to ETFs).

Asset Class Comparison: Know Your Options

|

Asset Class |

Unit Trusts |

Exchange-Traded Fund (ETF) |

Stock |

Structured Warrant |

Bond |

|---|---|---|---|---|---|

|

What Is It? |

Unit Trusts hold a diversified portfolio of assets, including stocks, bonds, and money-market, providing broad exposure and potentially reducing risk through diversification. The price of a unit (known as the Net Asset Value) is calculated at the end of each trading day. |

ETFs are similar to unit trusts but are traded in exchange like stocks. Unlike unit trusts, which are priced at the end of the day, ETF prices fluctuate in real-time and can be traded anytime during market trading hours. |

Buying a stock means purchasing a share of ownership in a company. This allows you to benefit from the company’s growth through capital gains (share price increases) and possibly dividend payouts. |

Structured Warrants are derivatives that give you the option to buy (call warrant) or sell (put warrant) an underlying asset (e.g., stock or index) at a predetermined price within a specific timeframe. Structured Warrants are higher risk, more complex and suited for experienced investors. |

Bonds represent a loan to a company or government. In return, you receive regular interest payments and get back your initial investment (principal) at the end of the bond's term. Bonds are generally considered safe and offer moderate returns. |

|

Capital To Start |

Small |

Small |

Moderate |

Small |

Big |

|

Risk |

Low |

Low |

High |

Very High |

Low |

|

Return |

Moderate |

Moderate |

High |

Very High |

Moderate |

|

Complexity |

Low |

Low |

High |

Very High |

Medium |

|

Suitable Investors Type |

Beginner |

Beginner |

Intermediate |

Advanced |

Advanced |

Step 5: Track the Performance

Once you have invested, it is important to track your performance. Here is how to do it in simple steps:

See if the current value of your investments is higher or lower than what you originally put in. Most investment platforms or apps show this automatically, and it’s a quick way to see if your investments have grown or decreased in value.

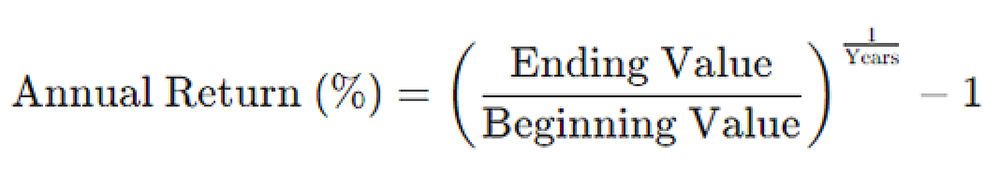

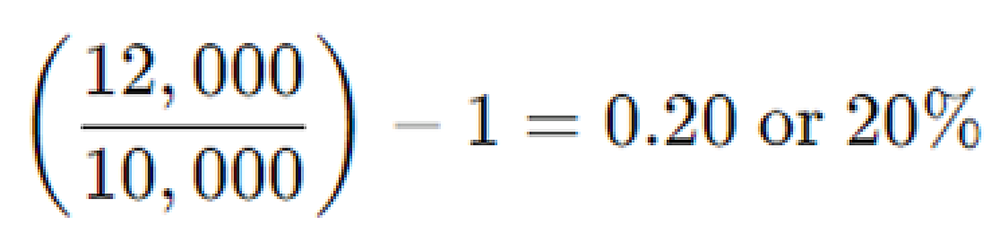

Alternatively, you can also use a simple formula to calculate your annual return. The formula is:

For example, if your RM10,000 investment grows to RM12,000 in a year, your annual return is

Check if your returns match the growth you need to reach your goal. If your goal requires a 4.63% return each year and you’re getting only 3%, you may need to adjust your investments. A performance attribution analysis shows which types of investments that have helped or hurt your portfolio performance.

Check your portfolio every few months or quarterly, rather than daily. This prevents you from stressing over short-term changes, which are normal in investing.

By following the methods above and tracking these, you will know if your investments are working for you or if you need to make changes to stay on track!

This advertisement has not been reviewed by the Securities Commission Malaysia.